Events

SpaceX’s $780 million bitcoin stack now down to about $545 million ahead of IPO filing

The company holds about 8,285 bitcoin in Coinbase Prime custody, a stake now worth roughly $545 million after a $235 million decline in value over the past three months.

SpaceX’s $780 million bitcoin stack now down to about $545 million ahead of IPO filing

The company holds about 8,285 bitcoin in Coinbase Prime custody, a stake now worth roughly $545 million after a $235 million decline in value over the past three months.

Ether, solana, xrp surge up to 10% as majors recover Saturday's war-driven losses

Solana led major tokens with a 10.8% bounce, while ether reclaimed $2,000 and bitcoin climbed back above $66,800 ahead of traditional futures opens on Sunday.

Ether, solana, xrp surge up to 10% as majors recover Saturday's war-driven losses

Solana led major tokens with a 10.8% bounce, while ether reclaimed $2,000 and bitcoin climbed back above $66,800 ahead of traditional futures opens on Sunday.

Polymarket attracts record trading 'world' volumes as U.S.-Iran bets top $529 million

A prediction market about military strikes on a sovereign nation now sits alongside presidential election bets as one of the most-traded contracts the platform has ever hosted.

Polymarket attracts record trading 'world' volumes as U.S.-Iran bets top $529 million

A prediction market about military strikes on a sovereign nation now sits alongside presidential election bets as one of the most-traded contracts the platform has ever hosted.

Bitcoin tops $68,000 after Iran confirms leader killed in U.S., Israel airstrikes

The death of Iran's supreme leader opens the door to regime change, and markets are pricing in a shorter period of tension.

Bitcoin tops $68,000 after Iran confirms leader killed in U.S., Israel airstrikes

The death of Iran's supreme leader opens the door to regime change, and markets are pricing in a shorter period of tension.

Here's how bitcoin's price rise could be fueled by job-stealing AI software

Bitcoin's future hinges less on technological factors and more on how AI affects growth, employment, real interest rates, and central bank liquidity, NYDIG Research argues.

Here's how bitcoin's price rise could be fueled by job-stealing AI software

Bitcoin's future hinges less on technological factors and more on how AI affects growth, employment, real interest rates, and central bank liquidity, NYDIG Research argues.

Bitcoin is stuck in a rut but JPMorgan says new legislation could be the ultimate spark

JPMorgan said the long-awaited Clarity Act would bring regulatory clarity, boost institutional participation and accelerate tokenization across U.S. crypto markets.

Bitcoin is stuck in a rut but JPMorgan says new legislation could be the ultimate spark

JPMorgan said the long-awaited Clarity Act would bring regulatory clarity, boost institutional participation and accelerate tokenization across U.S. crypto markets.

Iran crisis puts the regime's $7.8 billion crypto shadow economy in spotlight

The government relies on this crypto infrastructure for international trade, while ordinary Iranians use it as a financial lifeline during protests and economic crises.

Iran crisis puts the regime's $7.8 billion crypto shadow economy in spotlight

The government relies on this crypto infrastructure for international trade, while ordinary Iranians use it as a financial lifeline during protests and economic crises.

The 'stablecoin sandwich' is dead: Why the next phase of crypto payments is all about the user relationship

The real competitive advantage in stablecoins, the moat that holds competitors at bay, now lies in the distribution held by incumbents, according to the person behind Meta's abandoned Diem token.

The 'stablecoin sandwich' is dead: Why the next phase of crypto payments is all about the user relationship

The real competitive advantage in stablecoins, the moat that holds competitors at bay, now lies in the distribution held by incumbents, according to the person behind Meta's abandoned Diem token.

Crypto community fear of Iran choking oil supply and crashing markets may be overblown

A full closure of the strait is unlikely or impractical, some experts argue.

Crypto community fear of Iran choking oil supply and crashing markets may be overblown

A full closure of the strait is unlikely or impractical, some experts argue.

Former Mt. Gox CEO proposed a rewrite of bitcoin's code to recover $5 billion in stolen funds. Gets quickly shutdown

Mark Karpelès submitted a pull request to Bitcoin Core that would redirect coins that have remained untouched since 2011 to a recovery address controlled by the MtGox trustee, reigniting the…

Former Mt. Gox CEO proposed a rewrite of bitcoin's code to recover $5 billion in stolen funds. Gets quickly shutdown

Mark Karpelès submitted a pull request to Bitcoin Core that would redirect coins that have remained untouched since 2011 to a recovery address controlled by the MtGox trustee, reigniting the oldest debate in Bitcoin.

Suspected insiders make over $1.2 million on Polymarket by betting on U.S.'s Iran strike

The strikes caused bitcoin’s price to fall and oil futures on Hyperliquid to rise over the regional conflict’s consequences.

Suspected insiders make over $1.2 million on Polymarket by betting on U.S.'s Iran strike

The strikes caused bitcoin’s price to fall and oil futures on Hyperliquid to rise over the regional conflict’s consequences.

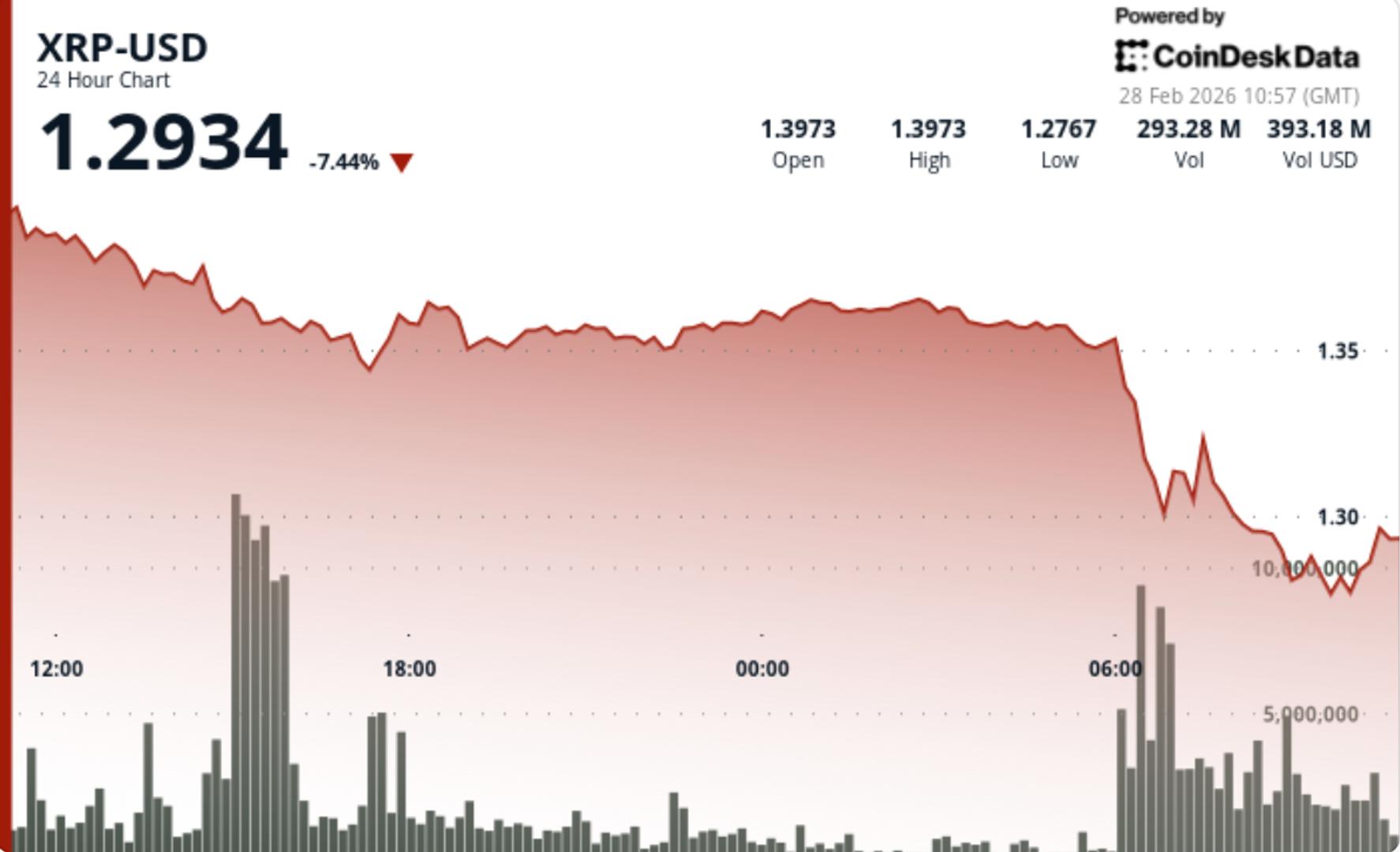

XRP tumbles 9% as break below $1.36 wipes out relief rally

Traders are watching $1.30 as immediate support after heavy-volume selling confirmed a bearish shift.

XRP tumbles 9% as break below $1.36 wipes out relief rally

Traders are watching $1.30 as immediate support after heavy-volume selling confirmed a bearish shift.

Bitcoin's five-month slide: why BTC is set for worst losing streak since 2018

With BTC down nearly 50% from its peak, analysts are sparring over whether the slump marks early repricing or signals more pain to come.

Bitcoin's five-month slide: why BTC is set for worst losing streak since 2018

With BTC down nearly 50% from its peak, analysts are sparring over whether the slump marks early repricing or signals more pain to come.

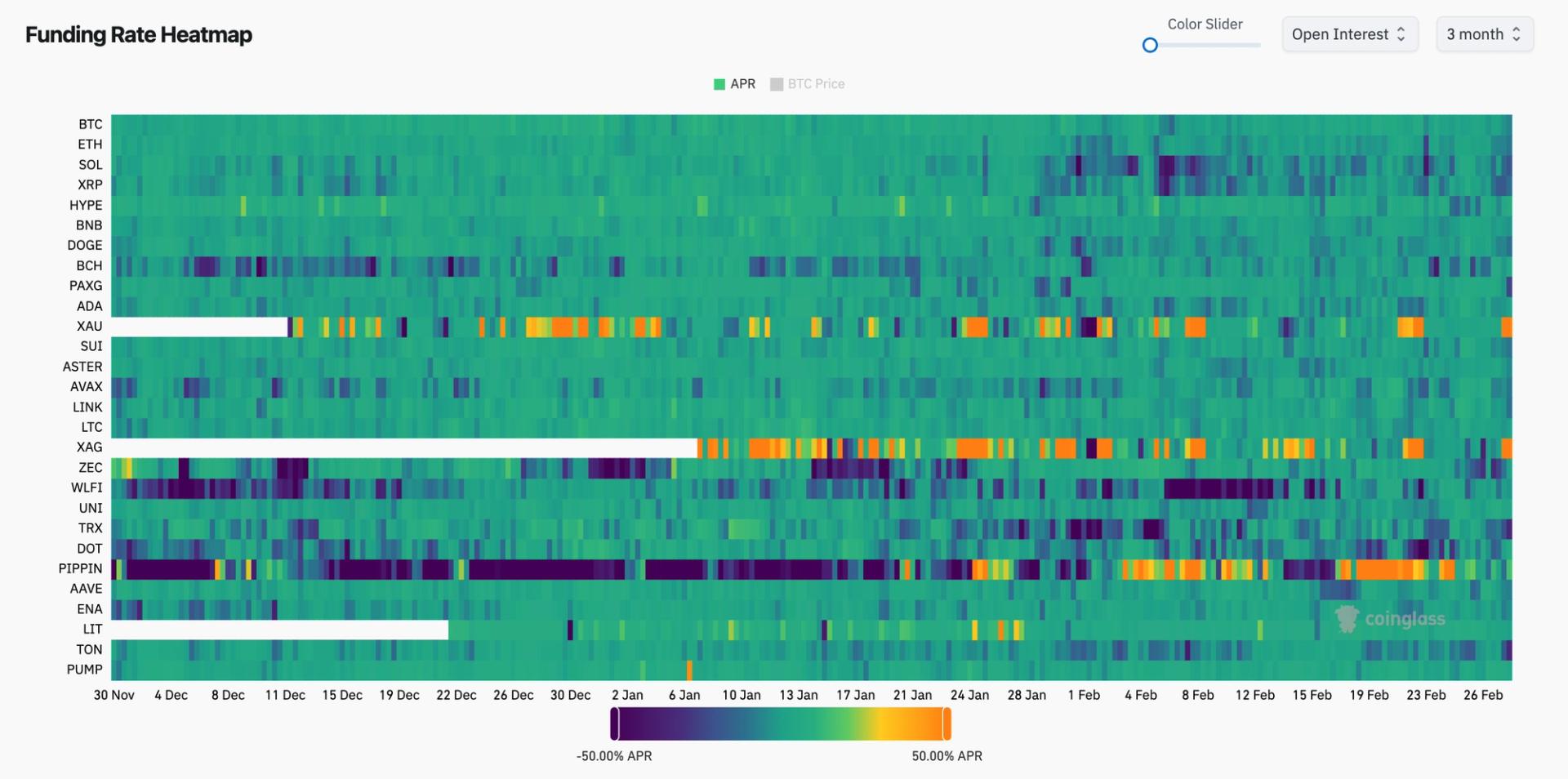

Bitcoin sets up potential short squeeze as 'funding rate' plunges to three month low

Negative funding rates, rising open interest and liquidations point to crowded positioning and heightened derivatives activity.

Bitcoin sets up potential short squeeze as 'funding rate' plunges to three month low

Negative funding rates, rising open interest and liquidations point to crowded positioning and heightened derivatives activity.

Bitcoin could see further downside risks as Iran attacks U.S. bases across Middle East

Tehran launched waves of missiles and drones targeting Israel, U.S. bases, and Gulf allies, with explosions reported in Dubai, Kuwait, and Bahrain.

Bitcoin could see further downside risks as Iran attacks U.S. bases across Middle East

Tehran launched waves of missiles and drones targeting Israel, U.S. bases, and Gulf allies, with explosions reported in Dubai, Kuwait, and Bahrain.

Oil-linked futures on Hyperliquid surge 5% after U.S.-Israel strike on Iran

Oil-linked futures on Hyperliquid’s HIP-3 surged after U.S. and Israeli strikes on Iran reignited fears of supply shocks.

Oil-linked futures on Hyperliquid surge 5% after U.S.-Israel strike on Iran

Oil-linked futures on Hyperliquid’s HIP-3 surged after U.S. and Israeli strikes on Iran reignited fears of supply shocks.

Bitcoin nears $63,000 as U.S. and Israel launch strikes on Iran

The drop extends a pattern where bitcoin sells off on geopolitical shocks before recovering, as the token's 24/7 liquidity makes it one of the few large assets traders can exit…

Bitcoin nears $63,000 as U.S. and Israel launch strikes on Iran

The drop extends a pattern where bitcoin sells off on geopolitical shocks before recovering, as the token's 24/7 liquidity makes it one of the few large assets traders can exit over the weekend.

Bitcoin slides to $65,000 in weekend sell-off, with solana, XRP, dogecoin down 6%

The pullback erased most of Wednesday's push toward $70,000 as hot producer-price data and a post-earnings Nvidia decline dragged risk assets lower heading into the weekend.

Bitcoin slides to $65,000 in weekend sell-off, with solana, XRP, dogecoin down 6%

The pullback erased most of Wednesday's push toward $70,000 as hot producer-price data and a post-earnings Nvidia decline dragged risk assets lower heading into the weekend.